Nasdaq 100 Returned 19% Annually—So Why Can't Most People Hold On?

[DISCLAIMER] This article is for educational and informational purposes only and does not constitute investment advice. Readers should consult with qualified financial professionals before making any investment decisions.

I've been getting a lot of questions about the Nasdaq 100 lately:

"Should I dollar-cost average into Nasdaq 100 or invest a lump sum?" "For a 15+ year investment horizon, is Nasdaq the best choice?" "Everyone's buying Nasdaq—should I go all-in too?"

I get it. When you look at the Nasdaq 100's historical performance, it's hard not to be tempted—

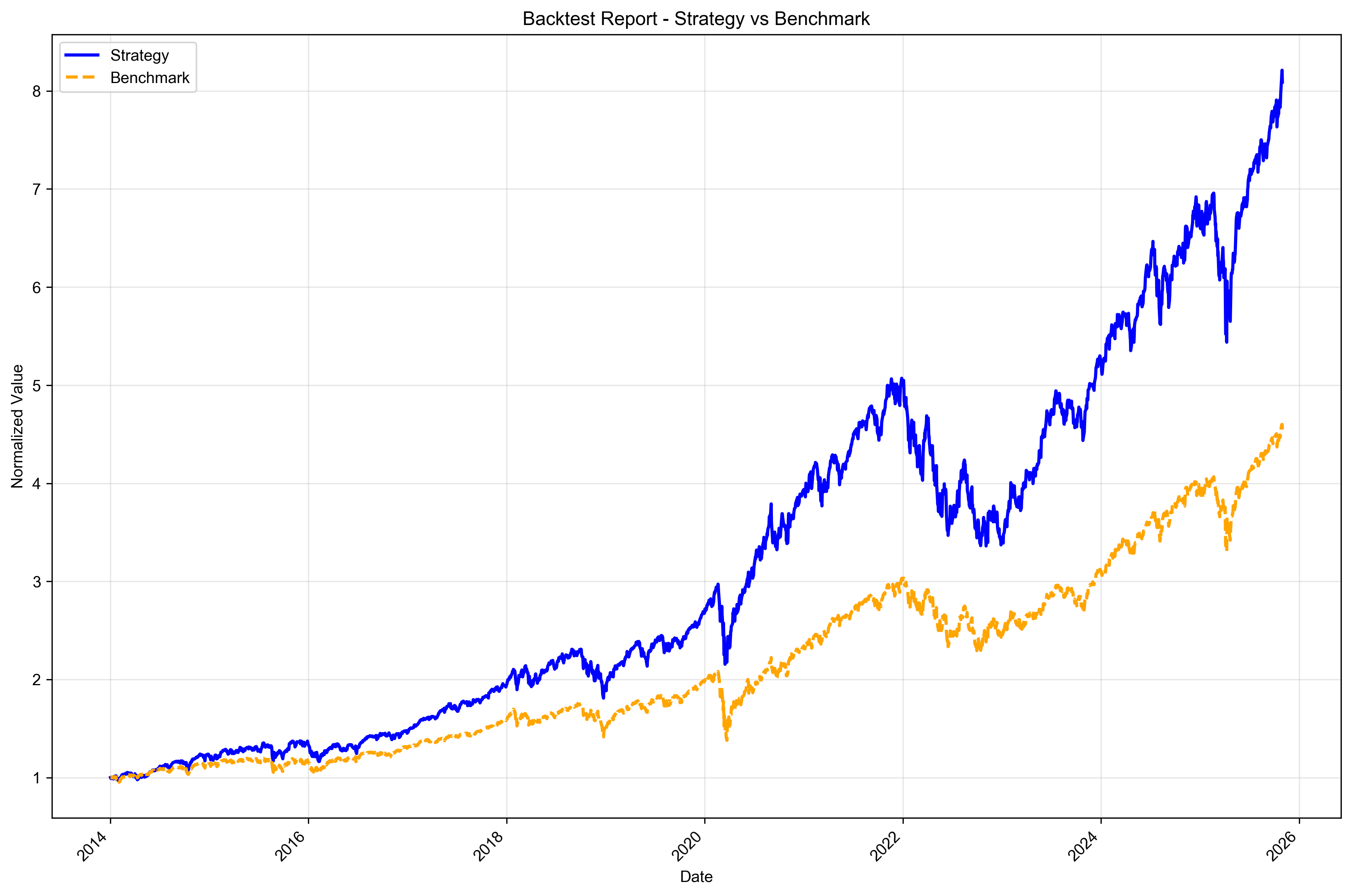

Over the past 11 years (2014-2025), the Nasdaq 100 delivered an annualized return of 19.36%.

What does that mean? If you invested $100,000 in early 2014, it would have grown to over $800,000 by 2025.

That crushes almost every other investment out there.

But here's what keeps puzzling me: If Nasdaq is so great, why do so few people actually get rich from it?

A Dataset Most People Ignore

Most people only see the 19.36% annualized return. Very few look at this data:

| Historical Drawdown | Maximum Decline | Recovery Time |

|---|---|---|

| 2000 Dot-Com Crash | -82.96% | 15.4 years |

| 2008 Financial Crisis | -49.29% | 3.4 years |

| 2020 Pandemic Crash | -28.56% | 3.5 months |

You read that right—in 2000, the Nasdaq 100 dropped 82.96%. $500,000 became less than $100,000. And then you had to wait 15 years just to break even.

Even during the relatively "mild" past 11 years, the Nasdaq 100 experienced a maximum drawdown of -33.72%, lasting 714 days—nearly two years.

Two years where your account was underwater. Two years of opening your brokerage app and seeing red.

Are you sure you could handle that?

What Does 15 Years Really Mean?

15 years isn't just an abstract number.

Let's break it down.

I. What Happens in Your Life

If you bought Nasdaq 100 in March 2000, you wouldn't break even until August 2015.

| Timeline | What's Happening in Your Life | Your Account Status |

|---|---|---|

| 2000 (Purchase) | Age 25, two years into your career, optimistic | Invested $50,000 savings |

| 2002 (Bottom) | Age 27, planning to get married | Down to $8,500 (-83%) |

| 2005 | Age 30, first child born | ~$20,000 (-60%) |

| 2008 (Second crash) | Age 33, kid starts preschool | Back down to $12,000 (-76%) |

| 2010 | Age 35, thinking about a bigger house | ~$25,000 (-50%) |

| 2013 | Age 38, kid starts elementary school | ~$40,000 (-20%) |

| 2015 (Break even) | Age 40, kid in middle school | Finally back to $50,000 |

From age 25 to 40—the prime years of your life—this investment was underwater the entire time.

Your child went from birth to middle school graduation. Your account went nowhere.

II. What You'll Face During Those 15 Years

Major Life Expenses

Over 15 years, you'll almost certainly face these money moments:

- Wedding: Ceremony, honeymoon, maybe a down payment

- Having kids: Medical bills, childcare, diapers, formula

- Buying/upgrading a home: Down payment, closing costs, renovations

- Children's education: Daycare, activities, college savings

- Aging parents: Medical care, assisted living, emergencies

- Career changes: Starting a business, unemployment gap, going back to school

- Unexpected events: Major illness, accidents, family emergencies

At any of these moments, you might need to tap that money.

And where's your account? Probably down 50%.

Do you cash out at a massive loss to cover urgent expenses? Or go into debt to preserve the investment?

Neither choice feels good.

Better Opportunities Passing You By

Over 15 years, you'll watch countless "better opportunities" slip away:

The allure of safety:

- 2006-2007: CDs and money markets paying 4-5%, principal guaranteed

- 2018-2019: High-yield savings accounts at 2-3%

- Meanwhile, your Nasdaq investment? Still underwater.

Other assets soaring:

- 2003-2007: S&P 500 nearly doubles

- 2009-2011: Gold surges from $800 to $1,900

- 2012-2021: Real estate in major cities doubles or triples

- 2020-2021: Bitcoin rockets from $3,000 to $69,000

Every time, you'll think:

"If I'd just kept it in a savings account, at least I'd still have my principal..."

"If I'd bought a house instead, I'd have tripled my money by now..."

"If only I had..."

Would you still believe in Nasdaq?

III. The Psychological Torture, Year by Year

Let's walk through your mental state over those 15 years:

Year 1 (2000-2001): Shock and Denial

"Down 40%? This is just a temporary correction..."

"Tech is the future. Long-term, this will be fine."

"There's no way it doesn't come back."

You start checking your account constantly, refreshing multiple times a day, hoping for a bounce.

Years 2-3 (2001-2003): Fear and Despair

"It's still falling? Down 70% now..."

"Did I just make the worst decision of my life?"

"Why didn't I listen when people warned me?"

The numbers make your stomach churn. You start avoiding the app—but can't help checking anyway. Every time you look, you feel worse.

Years 4-7 (2003-2007): Numbness and Doubt

"I've already lost so much, selling now won't get me much back..."

"Everyone around me made money on real estate. What was I thinking?"

"Should I cut my losses? But after losing this much, how can I give up now..."

You start avoiding investment conversations. When colleagues talk about their stock gains or home appreciation, you stay silent.

Years 8-10 (2008-2010): The Second Blow

"It was finally recovering, and now it crashes again?!"

"The 2008 financial crisis... everything's falling..."

"I really can't take this anymore..."

Just when you'd climbed partway out of the hole, you get knocked back down. This "second wound" feels worse than the first.

Years 11-14 (2010-2014): The Endless Wait

"When will this ever end..."

"It's been over a decade. How much longer?"

"All my savings from my twenties, just stuck here..."

You've stopped hoping for big gains. You just want to break even. But that day always seems to be tomorrow.

Year 15 (2015): Finally Break Even

"I'm back! I finally broke even!"

"But wait... 15 years, and I made nothing?"

"If I'd just put it in a savings account, I'd have earned more in interest..."

15 years. You didn't lose money, but you lost time, opportunity cost, and years of psychological torment.

IV. The Social Pressure

Over 15 years, you'll hear these comments constantly:

From family:

"I told you not to gamble on stocks!" (Parents)

"That money could have been our down payment..." (Spouse)

"Everyone else owns a home. We're still renting..." (In-laws)

From friends:

"You still haven't broken even on that Nasdaq thing?"

"I doubled my money on [whatever] last year."

"Long-term investing? You've been stuck for 10 years!"

From coworkers:

"Mike's fund is doing great. What are you in?"

"Oh, Nasdaq? Still down, huh?"

From the internet:

"US stocks are about to crash! Get out now!"

"The Nasdaq bubble is worse than 2000!"

"Smart money is rotating into [other asset]. Why are you still waiting?"

The hardest part? Watching everyone else succeed:

- Your coworker bought a house. It doubled in 3 years.

- Your friend got into crypto. 10x in one year.

- Influencers post their incredible returns.

- Your neighbor bought Apple at $20.

Meanwhile, you're still waiting to break even.

Every "success story" is another punch to your conviction.

V. The Moments When People Give Up

Research shows that people are most likely to give up not at the bottom, but at these moments:

| Moment | Psychological State | Typical Thought |

|---|---|---|

| Small bounce followed by another drop | Hope crushed | "Fooled again. I'm done this time." |

| Seeing others make money | Relative deprivation | "If only I had..." |

| Urgent need for cash | Forced to face reality | "No choice. Have to take the loss." |

| Holding longer than expected | Patience exhausted | "They said long-term, but not THIS long" |

| Seeing experts turn bearish | Self-doubt | "Even the pros say it's going down. Should I bail?" |

Over 15 years, moments like these happen dozens—maybe hundreds—of times.

Each one tests your conviction.

Are you sure you could survive every single one?

Data shows that during major drawdowns:

| Drawdown Level | Investor Behavior |

|---|---|

| -10% | ~20% start feeling anxious |

| -20% | ~40% consider selling |

| -30% | ~60% have sold or are about to |

| -50% | ~80% have already exited |

| -80% | Less than 5% still holding |

Do you really think you'd be in that 5%?

VI. A Brutal Math Problem

Imagine in 2000 you had $50,000 and faced three choices:

Choice A: Go All-In on Nasdaq 100

- 2000: $50,000

- 2015: $50,000 (break even)

- 15-year return: $0

- Annualized return: 0%

Choice B: Bank CDs (averaging 3%)

- 2000: $50,000

- 2015: $77,900

- 15-year return: $27,900

- Annualized return: 3%

Choice C: Buy Real Estate (assume 5x appreciation)

- 2000: $50,000 down payment on a $200,000 home

- 2015: Home worth $500,000+

- 15-year return: $300,000+ (equity)

- Annualized return: 11%+

15 years later, you look at your neighbor's $500,000 house, then at your account that just got back to $50,000.

Would you still say "long-term investing always works"?

VII. This Isn't Fear-Mongering

By now, you might be thinking:

"Are you just trying to scare me away from Nasdaq?"

No.

The Nasdaq 100 is still an excellent investment. The 19.36% annualized return over the past 11 years is real.

But I want you to understand:

The flip side of high returns is the price you must pay.

That price isn't just "numbers going down on a screen." It's:

- 15 years of opportunity cost

- Countless sleepless nights

- The regret of watching other opportunities pass by

- Pressure from family, friends, and society

- Constantly questioning your own decisions

If you're truly prepared to endure all of this, then go all-in.

But if you're not sure you can handle it, shouldn't we consider whether there's a more "human-friendly" way to invest?

3 Questions for Your Soul

Before you decide, answer these three questions honestly:

Question 1: If your account dropped 30% tomorrow, what would you do?

Not hypothetically. It actually happens. $100,000 becomes $70,000, and it might keep falling for another year.

- A. Hold firm, maybe even add more

- B. Wait and see, hope for a bounce

- C. Can't take it, sell some

- D. Sell everything, preserve what's left

If your answer isn't A, you may be overestimating your risk tolerance.

Question 2: Can you truly leave this money untouched for 15 years?

Over 15 years, you might face: job changes, buying a home, getting married, having kids, paying for education, parents' health issues...

Any of these could force you to sell at the worst possible time.

Question 3: If there was a strategy that sacrificed 2-3 percentage points of annual return, but reduced maximum drawdown by 8 percentage points and shortened recovery time from 714 days to 106 days—would you take it?

This isn't hypothetical. These are real backtest results.

An Option Most People Overlook

When considering a Nasdaq investment, most people see only two choices:

- Go all-in → Endure high volatility

- Don't invest → Miss out on high returns

But there's a third option: Use asset allocation to capture most of the returns while dramatically reducing volatility and drawdowns.

This isn't complicated financial engineering. It's simple math:

When Nasdaq rises, other assets might rise less.

When Nasdaq falls, other assets might fall less—or even rise.

Combined together, the volatility gets "smoothed out."

How exactly should you allocate? What percentages? What are the actual results?

A Deeper Analysis

I've covered these questions in detail in another article with complete backtest analysis:

Recommended Reading: "Why Going All-In on Nasdaq 100 Keeps Me Up at Night"

In that article, you'll find:

- Complete 11-year backtest data: 100% Nasdaq vs. diversified portfolio

- Detailed comparisons of max drawdown, recovery time, Sharpe ratio, and Sortino ratio

- Why "rebalancing" can shorten recovery from 693 days to just 106 days

- Who should go all-in on Nasdaq, and who should diversify

What's the biggest risk in investing? It's not picking the wrong asset—it's exiting at the wrong time.

A strategy you can actually stick with is a good strategy.

Follow Uncle Haowai—Making Personal Finance Simple.

Homework

Before reading the in-depth article, take a moment to reflect:

What's the largest single holding in your current portfolio? What percentage does it represent? If it dropped 30% and stayed down for two years, how long could you hold on without selling?